Accounts Payable Outsourcing Services Reduce Costs in U.S. Healthcare Sector

Accounts payable outsourcing services offer scalable, compliant support for healthcare finance teams across the U.S.

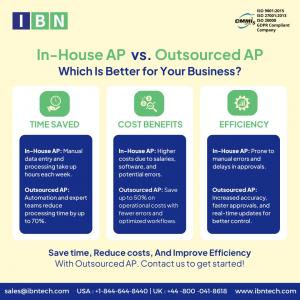

MIAMI, FL, UNITED STATES, July 4, 2025 /EINPresswire.com/ -- Across various sectors in the United States, organizations are turning to outside financial experts to handle increasingly complex back-office operations. One of the most effective solutions is accounts payable outsourcing services, which help minimize financial leakage, reduce manual errors, and improve cash management. In the healthcare field—where administrative loads are heavy and compliance standards like HIPAA are stringent—outsourcing AP tasks has become a dependable strategy. By working with experienced external teams, healthcare facilities can ensure regulatory adherence while redirecting their internal efforts toward patient-focused activities.The ability to adapt quickly is another driving factor. Outsourced financial partnerships allow organizations to scale up or down as needed without burdening internal staff. Notable accounts payable outsource providers such as IBN Technologies offer structured workflows, advanced controls, and built-in risk management. As healthcare, manufacturing, and retail companies face mounting compliance pressure, many are adopting accounts payable outsourcing services to enhance vendor performance and maintain financial consistency.

Need help upgrading your payables process?

Claim a Free Strategy Session: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Operational Friction in Healthcare Accounts Payable

Healthcare organizations face mounting financial and administrative complexity as they navigate the demands of modern accounts payable functions. Limited resources, shifting regulations, and fragmented systems make it difficult for internal teams to maintain smooth, accurate AP processes.

Key challenges include:

1. Difficulty reconciling revenues from multiple financial platforms, including insurers, patients, and government entities

2. Fluctuating cash inflows that disrupt budgeting, forecasting, and day-to-day financial planning

3. Persistent delays in processing vendor credits, refunds, and insurance claims

4. Misalignment and inconsistencies in account coordination across departments and facilities

5. Heightened pressure to safeguard sensitive financial data under stringent regulatory frameworks like HIPAA.

IBN Technologies delivers targeted support for the healthcare field by applying industry-specific protocols that meet both compliance requirements and internal reporting needs.

Creating Stability in Healthcare AP Workflows Across New York

Healthcare providers in New York are partnering with experienced AP service providers to bring consistency and control to critical financial operations. Managing vendor payments, addressing billing discrepancies, and meeting compliance standards requires precise execution—something seasoned outsourced teams are equipped to deliver.

Their structured approach to accounts payable procedures ensures that every invoice is handled accurately and on time. Key components supporting New York healthcare institutions include:

✅ End-to-end invoice capture and validation tailored to state-specific needs

✅ Direct vendor coordination to ensure uninterrupted medical service

✅ Ongoing monitoring of cash flow to maintain financial stability

✅ Adherence to vendor contracts and terms to prevent delays or penalties

✅ Full-cycle reconciliation aligned with audit and compliance standards

✅ Insightful reporting to support strategic financial decisions

Through its complete suite of accounts payable outsourcing services, IBN Technologies empowers New York healthcare organizations to reduce inefficiencies, manage spending effectively, and remain audit-ready—ensuring reliable financial performance in a highly regulated environment.

IBN Technologies Drives Excellence in Healthcare Payables Operations

By outsourcing AP, healthcare institutions gain access to advanced processing tools and dependable workflows—without sacrificing compliance. IBN Technologies offers a cost-effective and scalable service model that improves financial clarity and operational speed. Their framework delivers key outcomes such as:

✅ Organized data management for insurance and vendor invoices

✅ Fewer payment processing errors and improved record accuracy

✅ Financial statements that support healthcare audit standards

✅ Transparent payment tracking and budget controls

✅ Shortened payment cycles and reduced clerical delays

These solutions integrate effectively with existing accounts payable systems, allowing for smoother operations and dependable financial visibility across departments.

Proven Financial Benefits for Healthcare Institutions in New York

Healthcare facilities across New York that have adopted accounts payable solutions from IBN Technologies have experienced notable performance improvements. Key benefits include:

• Up to 40% increase in cash availability through faster invoice approvals and more efficient payment cycles

• Streamlined workflows and reduced operational expenses, fostering stronger, more reliable vendor partnerships

In addition to these measurable gains, outsourcing AP functions has helped New York-based providers simplify audit preparation processes. With accurate, up-to-date documentation and reduced administrative burden, healthcare institutions are achieving greater financial clarity and compliance readiness.

Driving Financial Resilience in a Changing Healthcare Landscape

The healthcare environment continues to evolve with rising costs, stricter regulations, and ongoing operational challenges. To remain sustainable, many organizations are building reliable financial systems powered by flexible accounts payable outsourcing services. These services form the foundation of smarter, more adaptable financial planning.

By outsourcing, healthcare providers reduce internal workload while gaining tighter control over financial operations. This leads to better supplier partnerships, more predictable cash cycles, and stronger readiness to handle economic or policy-driven changes. IBN Technologies plays a key role in enabling this transformation, supporting clients with long-term financial stability and strategic oversight.

For organizations with hybrid finance teams or remote staff, IBN Technologies also offers remote accounts payable manager services—ensuring continuous coverage and smooth operations regardless of location.

Related Services:

Outsourced Finance and Accounting

https://www.ibntech.com/finance-and-accounting-services/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release