Initial Appeals Lower Bexar County Commercial Value by 6.7%

O'Connor discusses how the initial appeals lowered Bexar County commercial value by 6.7%.

SAN ANTONIO, TX, UNITED STATES, July 24, 2025 /EINPresswire.com/ --

Unlike most Texas counties, Bexar County did not see gigantic taxable value increases in 2025. With a growth of 2.2% for residential and 7.5% for commercial property, value largely stayed in the realm of reasonable numbers. The San Antonio area has been growing organically, which these numbers could reflect. There is a fine line between healthy economic improvement and blatant overvaluation by the appraisal district, one that Bexar County has been walking for years.

The Bexar Appraisal District (BCAD) also has a reputation for being permissive with property tax appeals, which makes things easier for those taxpayers that wish to fight the values handed to them. Over 26% of Bexar County property was protested in 2023, a figure that is constantly growing. Informal appeals have been wrapped up and formal hearings before the appraisal review board (ARB) are beginning. O’Connor will cover how successful informal appeals were and what influence they had on the taxable value across Bexar County.

Informal Appeals Slice 0.7% from 2.2% Gain for Homes

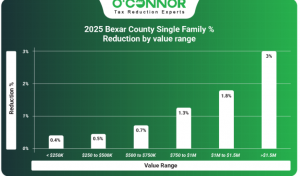

In 2023, over 99% of informal appeals for residential properties received some form of reduction, one of the largest percentages in Texas. This means that BCAD’s numbers are both inaccurate and that they are willing to change them. It is not surprising then, that there was a slew of appeals launched against BCAD in 2025 as new values were announced. Informal appeals were able to reduce values in total by 0.7%, pulling back around a third of what had been increased. Homes worth between $250,000 and $500,000 were the main generators of value in Bexar County and saw a cut of 0.5% to their values. Homes below $250,000 were the next block, landing a reduction of 0.4%. Though they represent a smaller chunk of value, larger homes saw substantial savings. Notably, homes worth over $1.5 million achieved a reduction of 3%. These numbers are sure to be improved upon in the ARB cycle.

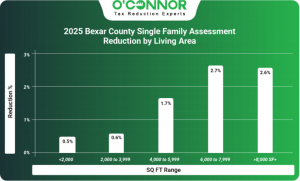

Bexar County is a traditional Texas area and is mainly focused on working families and middle-class workers. This is reflected in the size of homes and how they contribute to value. Homes under 2,000 square feet contributed $78.33 billion to the total and achieved a reduction of 0.5%, while those between 2,000 and 3,999 square feet were responsible for $87.89 billion in value before being reduced by 0.6%. As we saw with worth, larger homes got a higher percentage in savings while creating less of the total value. Homes over 8,000 square feet managed a savings of 2.6%, while only contributing $872.94 million to the total.

Bexar County has been growing steadily over time, but seemingly in a more sustainable way than trendier communities. 39% of all residential value in the county was built between 2001 and 2020, while 23% was built between 1981 and 2000. These two categories received reductions of 0.7% and 0.6%. New construction now accounts for 9% of all home value and still managed to claw back 0.7% after seeing a value increase of 25.8%. Even older homes were able to achieve cuts, with the oldest landing a reduction of 0.9%.

Commercial Appeals Almost Balance the Books

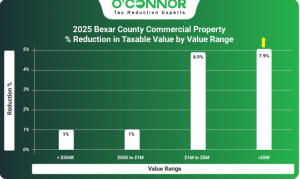

According to BCAD, commercial property increased in value by 7.5% to $52.98 billion. Appeals were quickly filed, as they always are for commercial properties, and an impressive reduction of 6.7% was returned. $42.84 billion in value came from commercial properties worth over $5 million, and these large businesses received a massive reduction of 7.9%. Commercial properties worth between $1 million and $5 million were in the No. 2 spot and managed to slash 4.9% from the books. Even the smallest of businesses landed a cut of 1%.

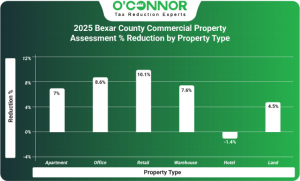

Like most urban areas in Texas, the largest chunk of commercial value is tied to apartments and other multifamily residential properties. These were initially responsible for $24.21 billion in value but were soon reduced by 7% thanks to informal appeals. Raw land accounted for $10.01 billion but likewise got cut down by 4.5%. Retail was in third place and saw a giant reduction of 10.1%. Only hotels were notable for not achieving a reduction when it came to all commercial categories.

While they generally follow the same pattern as residences when it comes to value and age of construction, commercial property is weighted even more towards recent construction. 41% of all value was built in the boom period between 2001 and 2020. As the primary driver of value, the 6.2% cut this category received set the pace for the rest of the commercial properties. 22% of value was built between 1981 and 2000, while new construction accounted for 7%. These properties received reductions of 22% and 7% respectively. Older construction combined for 15% of all value, with the two oldest categories getting solid savings as well.

Apartments Save 7%

Out-of-control increases for apartments have the double impact of hurting owners and renters. While the market value of apartments only increased by 3.8% in 2025, it was slashed 7% by informal appeals. This implies that apartments were already overvalued and were corrected. 51% of apartment value was built between 2001 and 2020, while 25% was built from 1981 to 2000. These two categories got reductions of 6.5% and 7.8% respectively. New construction experienced a boom in 2025, with its total value shooting up 61.1%. Appeals managed to lower it by 7.5%, but new construction still accounts for 12% of all apartments now.

BCAD breaks down all Bexar County apartments into three subtypes. The largest is high-rise apartments, which accounted for $23.95 billion in value, before being reduced by 7.2% thanks to informal appeals. Generic apartments were at a distant No .2 in value with $500.02 million and managed a cut of 3.8%. Small-unit apartments came in last but still managed to achieve a reduction of 3.8%.

Office Cuts Surpass Value Increases

Offices followed apartments by slashing more value than they accrued in 2025. Initially, BCAD claimed that offices had increased in value by 5.9%, totaling $8.41 billion. After informal appeals, this was reduced by 8.6%. The largest gain and largest cut were both linked to new construction, which originally shot up 31.8% only to be slashed by 38.7%. Though this is only 4% of the office total, it represents a startling reversal. This was seen for most other timeframes of construction, though on a lesser scale. 45% of office value was built between 2001 and 2020 and managed a strong reduction of 6.9%. Offices built from 1981 to 2000 were responsible for 35% of the total value but were also able to nab a reduction of 7%.

BCAD only classifies offices into two categories, reducing their usefulness for exploration. Generic office buildings were worth the most value, managing a cut of 6.7%. Medical offices managed to land an impressive reduction of 13%, cutting their value from $2.64 billion to $2.29 billion.

Retail Owners Recoup 10% Thanks to Protests

Retail property saw a growth of 15.7% in 2025, which translated into a jump in taxable value to $7.89 billion. It did not take long for business owners to respond, and initial appeals managed to land a total reduction of 10.1%. 47% of retail value was built between 2001 and 2020, which managed to get a massive cut of 9.8%. 24% was built between 1981 and 2000, while 17% was constructed from 1961 to 1980. These timeframes had reductions of 8.3% and 15.9% respectively. New construction was reduced by 8.7% after seeing a jump of 49.8%.

Retail stores are broken down into a greater variety by BCAD than other retail properties. Strip centers were the most valuable of all retail properties, totaling $2.85 billion before landing a reduction of 7.3%. In the opposite direction, regional shopping centers had the smallest total but saved the most with an astounding reduction of 31%. Community shopping centers were a happy medium with $1.61 billion in value and a reduction of 10.6%.

New Warehouse Construction Saves 15.6%

Atypically, warehouses are the least valuable commercial property in Bexar County. These are usually in second or third place in most counties. Warehouses did see their value increase by 14.5% in 2025, but this was soon lowered by 7.6%, cutting the jump in half. 53% of warehouse value was built between 2001 and 2020, while 26% was built between 1981 and 2000. These each saw respective cuts of 5.4% and 7%. New construction currently accounts for 12% of all value after being reduced by 15.6%. While only 5% of the total value, warehouses from 1961 to 1980 saw a reduction of 10.1%.

BCAD only classifies warehouses into one category, which is oddly mini warehouses. There is nothing more to add, as everything in the previous paragraph applies to this as well. Warehouses totaled $1.90 billion after seeing a reduction of 7.6%.

Bexar County Will Improve Upon Reductions

Out of all of the counties we have covered so far in this reduction series, Bexar has the best outlook for taxpayers. As stated above, BCAD is typically generous with informal appeals and in 2023, 99.2% of homes and 98.8% of businesses were able to get settlements from this appeal type. 2025 saw Bexar County experience record cuts at the informal level. While it is good news that appeals are granted so easily, it also implies that BCAD knows their values are unfair or at least inaccurate. This, along with the high success rate, means that all taxpayers in Bexar County should appeal.

And this is still not all of the appeals. The formal appeals to the ARB are still outstanding. In 2023, these went in favor of the taxpayer 99% of the time for homeowners and 84% of the time for business owners. This trend has been moving ever-upward and 2025 should be no different. This means that savings from appeals could easily double in the coming months, depending on how the ARB rules. With the ease of victory, it is little wonder that many taxpayers pushed past their informal settlements and are now going for an ARB hearing to add to their value cuts.

O’Connor is here to help at whatever stage you are in the tax appeal process. We have been fighting Texas property taxes for over 50 years and know how best to deal with BCAD, the ARB, or even how to approach lawsuits to really top off your appeal journey. We will also represent you and appeal your taxes every year, a true boon in Bexar County, where you have an excellent chance to win every year. Every victory can be compounded with the next, building a portfolio that will maximize your savings. It is free to join, and you will only pay if we lower your taxes.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release