Reassessment Hits Evanston with 23% Residential Hike

O'Connor discusses the reassessment in Evanston that saw a 23% residential hike.

CHICAGO, IL, UNITED STATES, July 24, 2025 /EINPresswire.com/ -- The triennial reassessment is wrapping up in northern Cook County but the fall-out from it is just beginning. With another year of evaluations in the books, the Cook County Assessor’s Office (CCAO) is handing out property valuations for property owners across Cook County. These will then be used to calculate the infamous property tax bills that people all over the Chicago area hate and fear. While some steps have been taken to avoid the massive jumps experienced in 2023, anyone who has had their property evaluated by the CCAO is sure to see an uptick in their taxes.

Evanston Township was one of the centerpiece areas to be reassessed in 2025. The CCAO has released the values they will use, and they are gigantic. Total home values are up 23%, while the taxable value of commercial properties has experienced a rise of 35%. With legislation stalled, the only way to find relief is to use property tax appeals. Informal appeals to the CCAO have already closed, but the deadline for appeals to the Board of Review (BOR) is set for August 5,2025. O’Connor will discuss how property values have climbed across Evanston Township and where they grew the most.

Residential Increases Cast a Wide Net

Evanston Township has a wide and diverse residential property portfolio with homes of all different types. The 23% increase in taxable value is spread across many types of homes and affects all strata of society. Evanston Township added $2.16 billion in value thanks to reassessment, bringing the total to $11.83 billion. The largest jump in value came from homes worth between $1 million and $1.5 million. Increasing by 32%, these homes added $592.04 million in value alone. Despite the rapid growth in value, homes in this price range were still in third place when it comes to total value.

Homes worth between $250,000 and $500,000 were in the No. 1 spot to start 2025 and, with an increase in value of 16, they managed to stay in the lead with a total value of $2.59 billion. Homes worth between $500,000 and $750,000 nearly caught them, spiking 22% to $2.50 billion. Homes worth under $250,000 only saw an increase of 4%, which is something of a gift for the smallest of homes. These residences represented the smallest share of the total at $769.44 million.

Larger and more expensive homes saw some of the largest increases, at least when it comes to percentages. Besides the aforementioned 32% increase for homes worth between $1 million and $1.5 million, residences worth between $750,000 and $1 million jumped up by 29%. The biggest homes in the township, those worth over $1 million, experienced an increase of 27%, adding over $300 million to their taxable value total.

How Evanston Compares to Other Cook County Townships

The entire northern area of Cook County is currently getting hit by the reassessment stick. While Evanston’s overall residential property value increase of 23% is severe, it is lower than many of the other townships in the area. Elk Grove experienced a rise of 26% in residential value, along with a whopping 52% in commercial property. Northfield homes went up 30% in value, with businesses going up 28%. Maine Township had increases of 25% and 36% for homes and businesses respectively. These numbers have thankfully avoided going into the 2023 debacle territory so far, but outliers are sure to exist.

Evanston Commercial Property Shoots up 35%

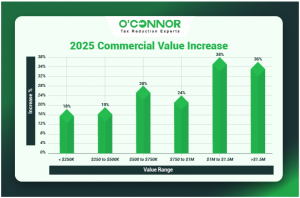

There has been a trend this year in reassessment that commercial rises are outstripping residential ones. While usually the reverse is true, it seems that businesses are bearing the brunt of this cycle. The CCAO has claimed that they want to protect homeowners, so this may be a result of that policy. Whatever the cause, every commercial property is seeing significant rises across the board. Even property worth under $250,000 saw a jump of at least 18%, despite being the smallest subtype by a large margin.

The worst hit of all commercial property by far was taken by those businesses that are worth over $1.5 million. While it is typical for big businesses to get the lion’s share of increases, the 36% spike seems excessive. This brought the value of such commercial properties up a combined $839.02 million for a total of $3.15 billion. The total for all commercial property was $3.55 billion, showing the importance of this subtype to the whole.

Commercial property worth between $1 million and $1.5 million saw the largest increase by percentage with 38%, gaining $40.55 million in value. Small commercial properties worth between $250,000 and $500,000 suffered an increase of 19%, while those in the next tier were hit by a jump of 28%. Mid-sized businesses worth between $750,000 and $1 million experienced a rise of 24%. While these affected the value total very little compared to the largest of commercial properties, all of them represent significant impacts on their respective bottom lines.

CCAO, BOR, and Other Government Bodies Recommend Appeals

The property tax process is complex and even the CCAO has encouraged property owners to appeal the property values handed to them. Record appeals were filed in 2025, and the process is still ongoing. It is clear that the bills being handed out have really little to do with reality and constitute a threat to the wallet of every resident.

The reasons to appeal are legion. First, some properties are not being assessed fairly when compared to similar properties. Due to a series of computer errors, valuations for years have been inaccurate, such as claiming vacant lots are worth the same as mansions or giving blatant false errors when it comes to the size of homes. Property values are expected to be late for the foreseeable future, and many are turning up to be inaccurate when they do show up. Even the appeal process has been fraught with problems, including accusations that commercial property appeal victories are being offset with higher taxes on homes. The Board of Review (BOR) and CCAO have been sniping at each other over values, while other government bodies claim that CCAO is purposefully stonewalling values and answers.

Evanston Township Deadline is August 5, 2025

While direct informal appeals to the CCAO closed months ago, taxpayers in Evanston Township can still take their appeals to the BOR. This is quickly becoming the favored way to protest in Cook County, as the CCAO and BOR are developing an adversarial relationship, and the board is often siding with taxpayers. The impartial BOR can cut through most of the issues caused by the CCAO and is usually the fairest shake a taxpayer can get. There is still time to file a BOR appeal, but that window will close on August 5, 2025.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, Texas, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release